One of the things I’ve noticed after working with dozens of startups over many years is that what works in the early days often doesn’t work as the company grows. Markets, customers and technologies are constantly changing. And you either change with it, or you risk falling behind. If you’re a high-growth company, doubling or tripling year over year, it will feel like a new business every twelve months. You’re targeting different buyers with different expectations and often facing different competitors.

The search for product / market fit is not a one time activity. As markets and buyers evolve, you need to continue to not only delight your existing customers, but also make your product a good choice for later, more cautious buyers.

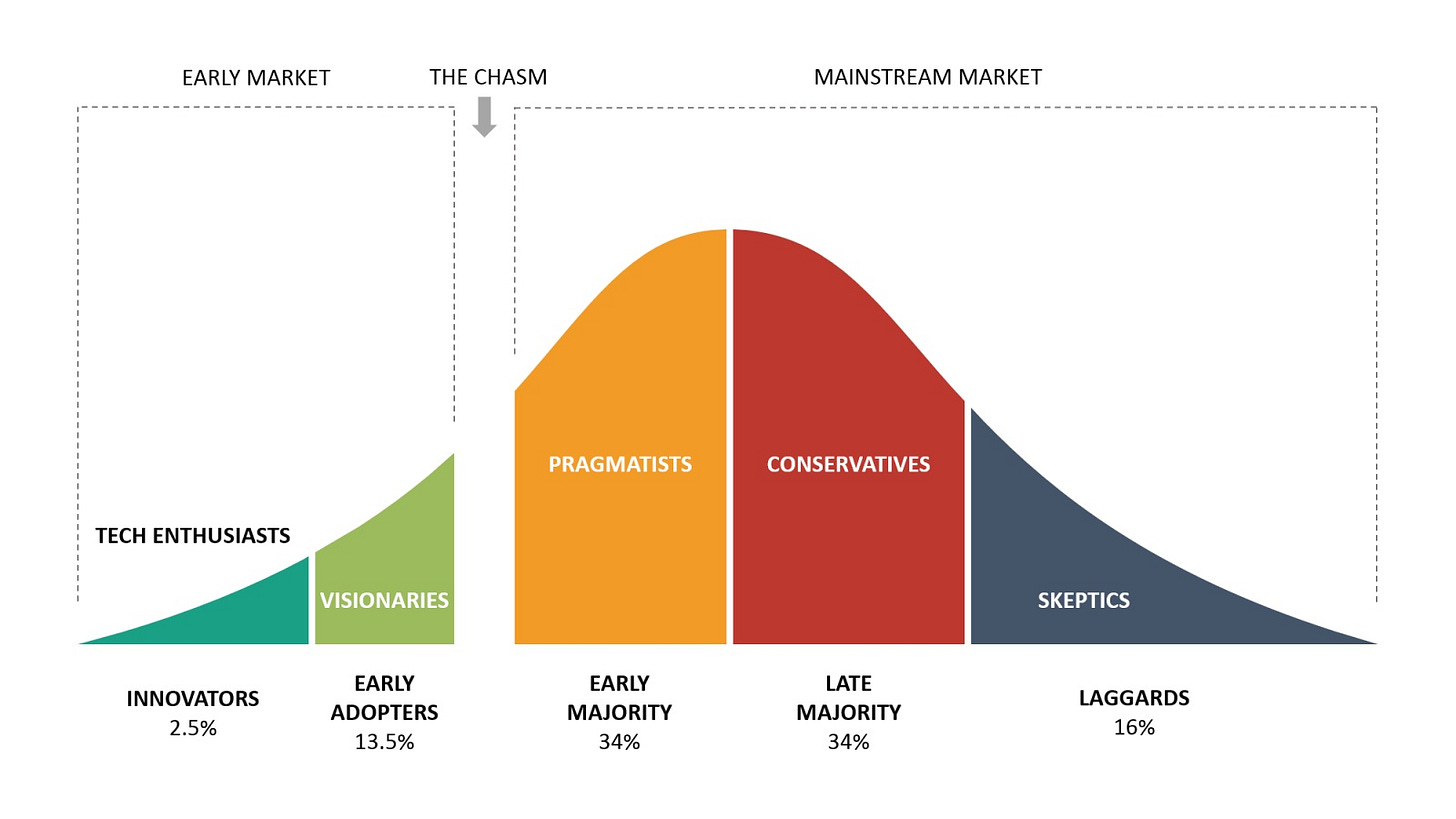

There’s an interesting paradox to all of this, which was summarized by Geoffrey Moore in his breakthrough book “Crossing The Chasm.” The book became a business bible for a generation of Silicon Valley entrepreneurs (and product managers!) in the 1990s.

The book describes the challenge startups face as they seek a mainstream market with wide adoption. The reality is that early buyers are completely different from those who come later. Everything from the product, to your marketing and your sales approach needs to be optimized for the stage you are at. Companies that fail to take this into account often find their growth flat-lining after they’ve sold to all the early adopters. The old tried and true early adopter techniques don’t work with mainstream buyers. This is the dreaded chasm in which many products and companies perish.

Let’s take a quick tour through the types of buyers that exist in the market to explain how buyers are different at each stage of the technology adoption lifecycle.

Innovators and Visionaries Want to be First

The Innovators (roughly 2.5%) are techno-geeks. They’re the first to try new technologies, often out of curiosity. They like to be early adopters, it’s part of their persona. They can be influential to others, showing how and when to use new technologies. They are willing to try something just because it’s new. They don’t have large budgets or departments and they like figuring things out. If you’re a founder you probably know people like this. You might even see one in the bathroom mirror every morning.

The Early Adopters (13.5%) are more disciplined in their assessment of technology. If they’ve got a problem to solve, they are open to new technologies, but they won’t use something new for its own sake. They are willing to purchase from startups, if it will give them a compelling competitive advantage or make their business more efficient.

Early adopters are technically savvy and able to do the necessary integration work and tuning in order solve their problem. They know they’re pushing the envelope and they are not dissuaded when there are a few speed bumps along the way. Most Early Adopters don’t need references. They will make their own assessment of the technology and they can be strong advocates for products they adopt.

These first two groups, Innovators and Early Adopters, are more alike than different. They define the early market buyers. And while it is challenging to move from the Innovators to the Early Adopters, that’s nothing like the change that’s needed to expand into the mainstream market by selling to Early Majority customers.

Mainstream Buyers Want a Whole Product

Early Majority buyers (34%) want to see references and case studies that demonstrate that the product is reliable. And they want references from customers who are like themselves, in the mainstream. If you show a mainstream customer a reference from an early adopter tech startup or innovative gaming company they’ll look at you like you’ve got horns on your head. “Do you think we’re a startup?”

Early Majority buyers typically also need to integrate your product with their existing systems. They likely don’t have the technical expertise to do this in house and will require additional services from you or a partner to implement a complete solution. They’re not just interested in features, they’re looking at the whole product: integrations, services, training, and so on. They will likely do a competitive bake-off between multiple vendors and will often be influenced by peers and industry analysts.

Selling into the Early Majority can provide your company with an extended high-growth trajectory. It’s a market that dwarfs the Early Adopters. Failing to sell to this market means your product is unlikely to get beyond a small niche of technical enthusiasts and visionaries. If you’re a venture backed company, cracking this market is essential to the long-term viability of your business.

If you’re in a startup you’re probably not going to sell to the Late Majority (34%) buyers. In fact, you should hard qualify opportunities out if they come from large, conservative companies. These buyers are slow to adopt new solutions and typically wait for a winner to emerge. These buyers would rather buy from market leaders such as Microsoft, Oracle, SAP and VMware than from up-and-coming private companies. They will typically want to evaluate alternative solutions and will likely go with “the safest choice” from a company that is well known. Serving the Late Majority is one reason large vendors acquire smaller companies. They know that putting their imprint on a startup can make it more acceptable to mainstream buyers.

Technologies have come and gone since ”Crossing The Chasm” was first published, but the book has not lost any of its relevance. For startups in their early stage a key piece of advice remains: identify a clear use case as a beachhead. Although it often feels paradoxical for founders, a more narrow focus can be the best way to concentrate the business so that you get repeatability. Usually that means targeting a specific problem or vertical market. Rather than limiting you, this focus gives you momentum and credibility that enables you to expand across adjacent segments. Without the narrow focus you might never get escape velocity beyond the early adopters.

From Zero to Five Million

At Gatsby, we had tens of thousands of open source users putting the technology into a broad range of applications. These were innovators who loved Gatsby’s static site generation approach and were eager to find situations where they could put it to use. They were true believers in the founders Kyle and Sam and their vision for a content mesh, the infrastructure layer for decoupled websites. They used Gatsby, the evangelized it, they built sites, and they brought Gatsby into thousands of companies around the world.

But truth be told, I suspect Gatsby flew under the radar in most organizations. Many of the early Gatsby applications were modest in size. And while we got a lot of developer love, we weren’t making much money.

Where we found commercial momentum was around CMS content management systems in larger organizations that were operating at scale. These early adopters were taking a big risk and they had specific integration requirements. In many cases they were moving off so-called monolithic Content Management Systems (such as Adobe Experience Manager, Drupal, Wordpress, as well as home grown systems.) They needed to integrate with newer decoupled systems such as Contentful, ContentStack and Sanity.

These early adopter customers were operating at a volume that we’d never seen before. There was clear risk involved (which we disclosed) and it required us to work very closely with their teams to optimize their build and deploy times. Kyle and other Gatsby engineers were able to perform some magic on Gatsby internals finding us steady 10x performance gains, without which customers would never have been able to go live.

These were at times painful situations, but we knew that the maturation of the technology was necessary for us to operate at Enterprise scale. We packaged up some of our know-how in the form of additional service bundles which not only were essential to making our early customers successful, but they helped raise our average deal size. Without these services, we never would have been able to make these customers successful. By focusing on Enterprise content management, we were able to grow from around zero to five million in ARR over two-and-a-half years. That was no world record, but it got us to the next stage of the market, for which I am proud.

Understand The Stage You’re In

As your company grows, it’s important to recognize when you are able to expand into the next stage of the adoption curve. Different techniques are required at every stage and you should listen carefully for signs from the market as to what will work best.

I routinely see companies that fail to make the transition from Product-led Growth to Enterprise sales, destined to burn increasing amounts of capital as they use early adopter techniques to reach early majority buyers. Spoiler alert: it doesn’t work. Enterprise buyers are different. They aren’t just looking for features, they need whole product solutions that integrate into their existing applications, infrastructure and workloads.

The good news is you are careful about identifying the right approach at each stage, you’ll find customers are willing to pay for what they need.

Love it! One of my favorite fundamentals, Zack.

One of the most overlooked effects of the Tech Adoption curve is how much companies later in the curve *discount* references from companies earlier in the curve.

Companies in different parts of the curve simply have different benefit preferences, I.e. the benefits and value propositions that are prioritized when making a purchase decision.

One antidote to this Customer Reference problem is for startups to find new design partners in the next later segment of the Tech Adoption Curve to refine the positioning and value props for that segment.

Make these design partners successful and realizing value, and generate new customer references that will entice other prospects in the segment.